They also provide customers with cost savings, fostering loyalty and repeat business. For instance, if a discount is offered in one tax period but the payment is received in another, the business must ensure that the discount is accounted for in the correct period. This is particularly relevant for businesses that operate on an accrual basis, where income is reported when earned, not when received. Properly timing the recognition of these discounts helps maintain compliance with tax laws and regulations. The allowance for doubtful accounts, a contra-asset account, may also be indirectly affected by sales discounts.

- Understanding how to navigate these adjustments is essential for maintaining accurate books and providing clear financial insights.

- Therefore, companies that offer small discounts for a 10-day payment return are able to clear their accounts quickly.

- Trade discounts help businesses build strong relationships with key customers and encourage larger orders, which can lead to increased market share and economies of scale.

- The bottom line is the same either way but, you are not incurring an expense when providing a discount, you are reducing your revenue.

- These discounts encourage customers to buy in larger quantities, helping businesses move inventory more quickly and reduce storage costs.

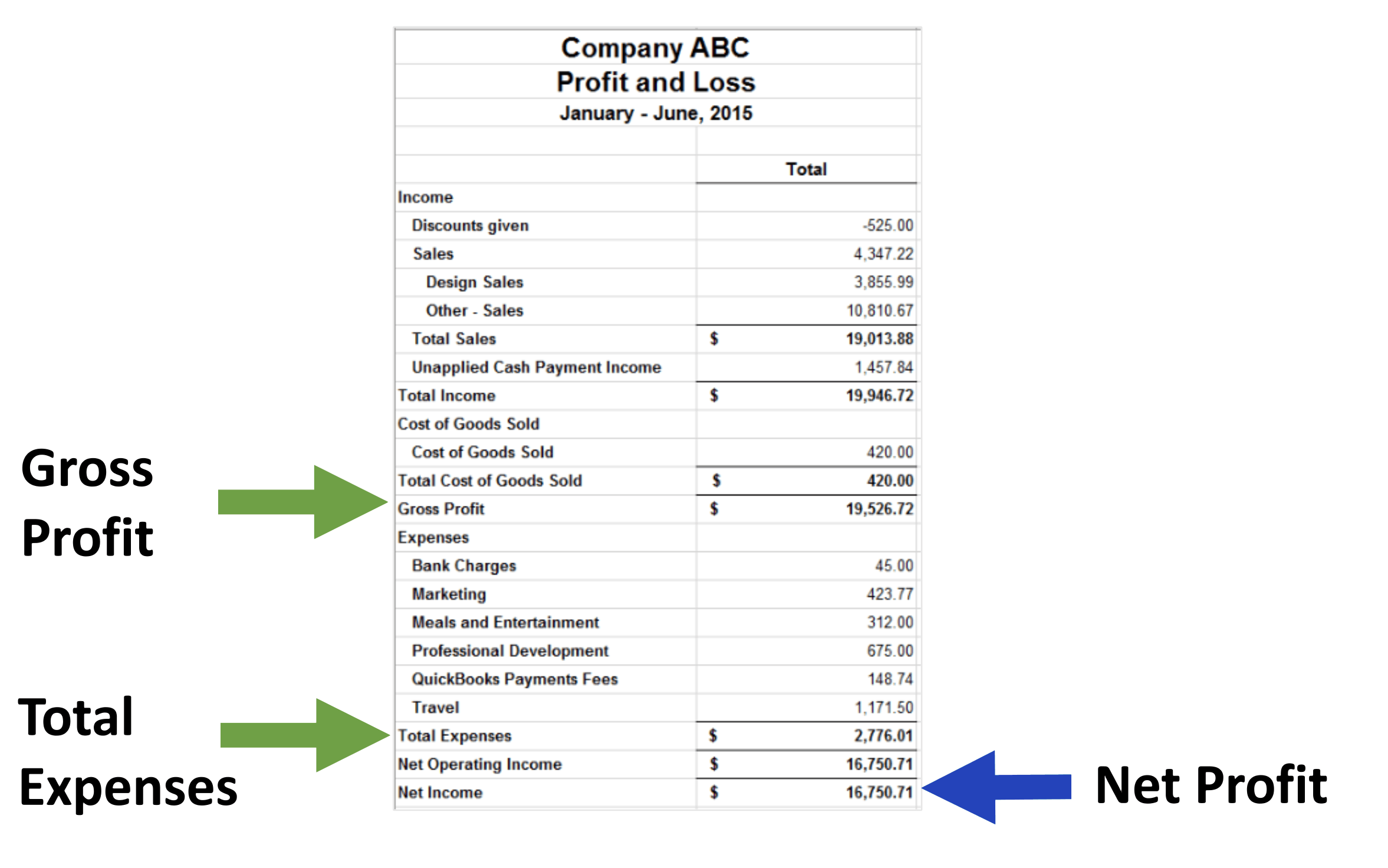

- Sales discounts have a direct impact on different parts of the financial statements, influencing how the business’s financial performance is perceived.

Do you already work with a financial advisor?

The first is to create a “contra-revenue” account and the second is to simply net the discount immediately off of the Revenue figure. A contra-revenue account is not an account that is shown in the entity’s Financial Statements. It is simply a placeholder account that the entity uses to keep track of their discounts. When preparing the year-end financial statements, the contra-revenue account is netted from the Revenue account, resulting in a Revenue figure net of all discounts. To illustrate a sales discount let’s assume that a manufacturer sells $900 of products and its credit terms are 1/10, n/30.

How Liam Passed His CPA Exams by Tweaking His Study Process

Trade discounts, unlike cash discounts, are not recorded separately in the accounting books. The sale is recorded at the net price after the discount, simplifying the accounting process. For example, if a product listed at $1,000 is sold to a retailer at a 10% trade discount, the journal entry would debit Accounts Receivable and credit Sales Revenue for $900. This approach ensures that the financial statements reflect the actual revenue earned from the sale, without the need for additional entries to account for the discount. Adjusting the accounts receivable to reflect sales discounts is a nuanced process. It involves updating the ledger to represent the reduced amount that a business expects to collect from its customers.

How confident are you in your long term financial plan?

This means that the business would collect and remit less tax on sales where discounts have been applied. It is essential for businesses to adjust their tax calculations to reflect these discounts to avoid underpaying or overpaying taxes. Most businesses do not offer early payment discounts, so there is no need to create an allowance for sales discounts. By doing so, you can immediately reduce sales by the amount of estimated discounts taken, thereby complying with the matching principle. A company may choose to simply present its net sales in its income statement, rather than breaking out the gross sales and sales discounts separately. This is most common when the sales discount amount is so small that separate presentation does not yield any material additional information for readers.

Using the same example, the initial entry would debit Accounts Receivable and credit Sales Revenue for $980. This method provides a more conservative approach, reflecting the anticipated cash inflow more accurately. The business receives cash of 1,950 and records a sales discount of 50 to clear the customers accounts receivable account of 2,000. The tax implications of sales discounts are an important consideration for businesses.

What is the approximate value of your cash savings and other investments?

However, these cash reductions offered to customers have an effect on a company’s financial statements so they must be recorded as a reduction in revenue under the line item called accounts receivable. As seen in the income statement above, the sales discount is a contra-revenue account and not an expense. As a contra revenue account, the sales discount appears on the income statement as a $5,000 reduction from the gross revenue of $100,000 that ABC Ltd reported, which results in net revenue of $95,000.

A Cash or Sales discount is the reduction in the price of a product or service offered to a customer by the seller to pay the due amount within a specified time period. When you’re dealing with a multitude of payment processing platforms—Stripe, PayPal—and ecommerce platforms like Shopify, manually tracking every discount can quickly become a nightmare. Not only does it eat up your time, which is already worth its weight is sales discount an expense in gold, but it also opens the door to mistakes, all of which can distort your financial statements. Suppose you’re selling $1,000 worth of products to a regular customer, and you offer a 10% trade discount. It’s already been briefly mentioned that a trade discount is a price reduction given to customers at the time of the sale. It’s usually based on the volume of goods purchased or the customer’s business relationship.

In this blog, I discuss the main factors that have a material impact on the above discounts. I also bring a few examples and discuss briefly the magnitude of the discounts we regularly apply. To determine the discounts, it is necessary to review carefully the legal documents of the entity such as the Partnership Agreement, Operating Agreement, or Bylaws.